Two Headed Monster – Part Two

The 2 Heads

In November of last year, I wrote an article entitled A Two Headed Monster – State Attorneys General and the Drug Enforcement Agency. The article was about the ongoing “two-headed” assault on the manufacturers to pharmacy shelves “supply chain” of pain medications.

The first “head” of the monster is the DEA. Specifically, it is the DEA’s annual production quotas for controlled substances. The second “head” of the monster is the 41 State Attorneys General’s nationwide opioid settlement with the three major distributors (wholesalers) of controlled substances, McKesson, Cardinal Health, and AmerisourceBergen. (AmerisourceBergen was “rebranded” Cencora in August of 2023.) In my article I referenced my colleague, Patricia Irving’s excellent Pain News Network article The National Opioid Settlement Is Causing Drug Shortages about this nationwide settlement’s “Injunctive Relief” very negative impact on the controlled substances supply chain from the manufacturers to pharmacies via these distributors. There has been recent very clear evidence substantiating just how harmful the implementation of this “Injunctive Relief” has become. Pat and I are collaborating on a future article about this important topic.

The 1st Head – Proposed versus Established Quotas

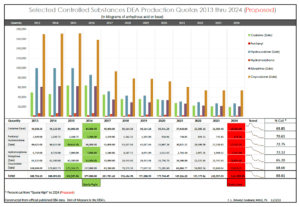

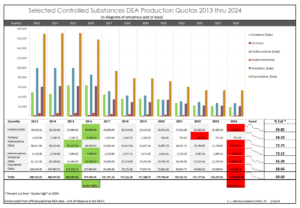

Today, I am “closing the loop” on my prior article’s discussion of the DEA’s annual controlled substances production quota cuts. My November 2023 article included the following graphic which I created based on official DEA published historical controlled substances production quotas for 2013 through 2023, and the DEA’s proposed production quotas for 2024. Regulations.gov.

I recently updated this graphic using the DEA’s final established production quotas for 2024. Federal Register :: Established Aggregate Production Quotas for Schedule I and II Controlled Substances and Assessment of Annual Needs for the List I Chemicals Ephedrine, Pseudoephedrine, and Phenylpropanolamine for 2024 . In doing so, I was shocked, actually initially panicked, that I had erred in my November 2023 edition of this graph. Can you spot the difference in the two?

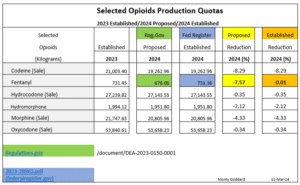

A short time later, after feverishly double checking my aforementioned references, I was relieved to learn, I did not screw up! The DEA had done the unthinkable! The DEA actually approved a higher 2024 production quota than they had previously proposed for at least one controlled substance. Fentanyl had been proposed for a 7.57% production quota cut. It was essentially left unchanged from the 2023 production quota which had been raised from 2022 production quota. I wonder if these two “out of the norm” actions by the DEA, were the result of “public comment”, or what? Did hospitals chime in due to fentanyl’s use in their operating rooms? I have not been able to find out the answer. But at least, I had not screwed up.

Here is a much simpler presentation of the proposed versus established production quotas of the controlled substances I graphed above.

The 2nd Head

The impact of the DEA’s annual production quotas cannot be overstated. The quotas for these controlled substances have been reduced by approximately 70% over the last decade. However, I am convinced the latest significant obstacles in filling legitimate Rx’s, so many are now experiencing, is the result of the 41 AG’s nationwide opioid settlement with the three major distributors than it is with the “monster’s” DEA head. Look at my graphs. It is easy to “see” for the last several years the production quotas have trended only slightly down or as in fentanyl’s case remained flat. In reaching my conclusion, I considered and promptly dismissed our aging population, and the still relatively rare but improved state Medical Board and state law prescribing “relief” potentially increasing prescribing of controlled substances prescriptions was adding to the current surge in pharmacy supply shortages. I have seen zero evidence prescribing is increasing the demand on the supply chain.

Pat and my article will provide recent evidence from patient experience and news articles that the settlement’s Injunctive Relief/Exhibit P imposed upon the three settling distributors is now the major force behind the uptick in pharmacy shortages, pharmacies unwillingness to fill legitimate prescriptions for opioid medications, and the forced tapering so many are experiencing at clinics and large medical groups. In the interim, I once again suggest you read for yourself the 54-page Injunctive Relief/Exhibit P. It begins on page 478 of the 571 page settlement: Final-Distributor-Settlement-Agreement-3.25.22-Final.pdf.

For those not up to reading all 54 pages, and as a “teaser” to entice more to do so, I’ll conclude with these representative samples of a VERY small portion of what the injunction REQUIRES of the three settling distributors, and thereby, the pharmacies and pharmacy chains they provide controlled substances:

Final Distributor Settlement Agreement – Selected Exhibit P Quotes

Page 2 – “Dispensing Data.” Includes, unless altered by the Clearinghouse Advisory Panel: (i) unique patient IDs; (ii) patient zip codes; (iii) the dates prescriptions were dispensed; (iv) the NDC numbers of the drugs dispensed; (v) the quantities of drugs dispensed; (vi) the day’s supply of the drugs dispensed; (vii) the methods of payment for the drugs dispensed; (viii) the prescribers’ names; (ix) the prescribers’ NPI or DEA numbers; and (x) the prescribers’ zip codes or addresses. The Clearinghouse will be solely responsible for collecting Dispensing Data.

Page 4 – b) A list of the top five prescribers of each Highly Diverted Controlled Substance by dosage volume and the top ten prescribers of all Highly Diverted Controlled Substances combined by dosage volume. For each prescriber, the data shall include the following information: (1) Number of prescriptions and doses prescribed for each Highly Diverted Controlled Substance NDC; (2) Number of prescriptions for each unique dosage amount (number of pills per prescription) for each Highly Diverted Controlled Substance NDC; (3) Prescriber name, DEA registration number, and address; and (4) Medical practice/specialties, if available; c) Information on whether the method of payment was cash for (a) Controlled Substances, and (b) non-Controlled Substances; and

Pages 10 & 11 – D. For purposes of the Injunctive Relief Terms, “Red Flags” are defined as follows: … 5. Out-of-area patients: Analyze Pharmacy Customer Data or Dispensing Data to assess volume of prescriptions for Highly Diverted Controlled Substances for out-of-area patients (based on number of miles traveled between a patient’s zip code and the pharmacy location, depending on the geographic area of interest) taking into consideration the percentage of out-of-area patients for non-Controlled Substances. 6. Cash prescriptions: Analyze Pharmacy Customer Data or Dispensing Data to assess percentage of cash payments for purchases of Controlled Substances taking into consideration the percentage of cash payments for purchases of non-Controlled Substances. 7. Prescriber activity of Customers: …

- For any Red Flag evaluation in Section VIII.D that may be performed using Pharmacy Customer Data or Dispensing Data, an Injunctive Relief Distributor will analyze the Red Flag using Pharmacy Customer Data, to the extent feasible based on the functionality of a Customer’s pharmacy management system, until Dispensing Data is collected and analyzed by the Clearinghouse as described in Section XVII. Until Dispensing Data is collected and analyzed by the Clearinghouse, an Injunctive Relief Distributor may satisfy the Red Flag evaluations in Sections VIII.D.5 through VIII.D.7 by engaging in considerations of out-of-area patients, cash payments for prescriptions and Top Prescribers

Page 12 – Obtain a “Pharmacy Questionnaire” completed by the owner and/or pharmacist-in-charge of the potential Customer. The Pharmacy Questionnaire shall require going-concern potential Customers to list their top ten (10) prescribers for Highly Diverted Controlled Substances combined, along with the prescriber’s specialty …

Page 13 – C. In the event that an Injunctive Relief Distributor identifies one or more unresolved Red Flags or other information indicative of potential diversion of Controlled Substances through the onboarding process or otherwise, the Injunctive Relief Distributor shall refrain from selling Controlled Substances to the potential Customer pending additional due diligence.

Page 21 -C. In determining whether a Customer should be terminated from eligibility to receive Controlled Substances, Injunctive Relief Distributors shall apply factors set out in their CSMP policies and procedures, which shall include the following conduct by a Customer: 1. Has generated an excessive number of Suspicious Orders, which cannot otherwise be explained; 2. Has routinely demonstrated unresolved Red Flag activity; …

Page 47 – f) Red Flags Review: (1) For each Reporting Period, the Monitor shall review the Red Flags defined in Section VIII and their incorporation into each Injunctive Relief Distributor’s policies and procedures. The Monitor shall determine whether the information reflects substantial compliance with the requirements of Section VIII and include any Observations and Recommendations, as called for by Section VIII.C, about those definitions in its annual Audit Report.