The announcement landed like a stone in murky waters — rippling outward in waves no one could fully map.

In a speech heavy on rhetoric and short on detail, former President Donald Trump announced a 90-day reprieve on reciprocal tariffs affecting several allied nations, while simultaneously hiking tariffs on Chinese imports to a staggering 145%. While the focus for many has been the broader implications for trade and geopolitics, a subtler — yet significant — story is unfolding in the background: what this means for American healthcare.

To understand the depth of this shift, it’s necessary to look beyond the headlines. For many U.S. hospitals, clinics, and supply chain managers, China is more than a geopolitical adversary — it’s a critical supplier of raw materials, medical devices, and generic pharmaceuticals. And a tariff this severe threatens to upend more than just economic diplomacy — it could inflate costs, disrupt care delivery, and compromise patient outcomes.

A 145% Shock to the System

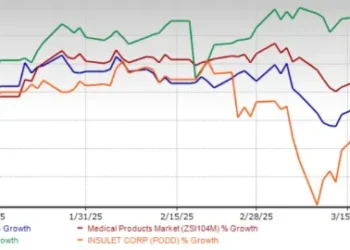

Trump’s tariff hike applies broadly to Chinese-manufactured goods, including many classified as medical products or industrial components used in medical equipment manufacturing.

These include, but are not limited to:

- Personal protective equipment (PPE)

- Active pharmaceutical ingredients (APIs)

- Surgical tools and diagnostic instruments

- Electronic components used in imaging and monitoring devices

A 145% tariff means that a $100,000 shipment of surgical masks, for example, could now cost hospitals $245,000 — a financial leap many institutions simply cannot absorb.

While some tariffs allow exemptions for medical products under national interest clauses, the scope and ambiguity of this policy announcement leave many healthcare administrators guessing. The long-tail keyword “how will Trump’s China tariffs affect healthcare?” has spiked in online search trends, signaling growing concern among industry stakeholders.

Why Healthcare Supply Chains Are Especially Vulnerable

Healthcare is a sector that runs on just-in-time logistics. Hospitals don’t warehouse a year’s worth of PPE or antibiotics. They rely on finely tuned global supply chains that deliver what’s needed, when it’s needed — often with little room for disruption.

Over the last two decades, globalization has driven U.S. healthcare toward cost efficiencies, resulting in a heavy reliance on overseas manufacturing, particularly in China and India. According to a 2023 report from the Department of Health and Human Services, more than 80% of key drug ingredients used in the U.S. are sourced abroad, with China being a dominant player.

Tariffs at this scale aren’t just a surcharge. They represent a recalibration of cost structures — one that could either be absorbed through higher prices or result in shortages, delays, or downgraded care quality.

The Economic Logic — and Its Limits

Supporters of Trump’s policy argue that steep tariffs will incentivize domestic manufacturing, reduce U.S. dependency on foreign suppliers, and eventually lead to more resilient supply chains. But critics point out that healthcare doesn’t operate on campaign timelines.

Bringing pharmaceutical or device manufacturing back to the U.S. is a multi-year endeavor, requiring regulatory approvals, skilled labor, and capital-intensive investments. In the interim, hospitals may face ballooning procurement costs — particularly smaller community hospitals already operating on razor-thin margins.

For patients, the downstream effect may be higher insurance premiums, increased out-of-pocket costs, or even rationed care for essential services like chemotherapy, dialysis, or imaging.

Providers in a Bind

For healthcare providers, these policy shifts translate into a new layer of financial uncertainty. The cost of compliance, budgeting, and forecasting becomes murkier when supply prices can jump 100% or more overnight.

“We were already dealing with inflation, labor shortages, and pandemic recovery,” said a supply chain director at a major hospital system in the Midwest. “Now we’re looking at the possibility of re-bidding entire vendor contracts based on one policy announcement.”

In sectors like radiology or cardiology, where high-tech imports from Asia are common, capital budgeting will be affected. Devices like CT scanners, ultrasound machines, and surgical robots depend on Chinese semiconductors and precision components.

If sourcing shifts or prices spike, patients could wait longer for diagnostic appointments or elective surgeries — a delay that can have life-altering consequences.

The Political Calculus and Healthcare’s Role

Healthcare has rarely been front and center in trade policy debates, but that may be changing. The Biden administration has tried to take a more measured approach to China, seeking to balance national security interests with economic interdependence. Trump’s sharp escalation, by contrast, signals a return to economic nationalism — a strategy that plays well on the campaign trail but creates real-world complexity in care delivery.

What makes healthcare unique in this context is that it’s not optional. Unlike luxury goods or discretionary consumer electronics, the demand for insulin, antibiotics, and ventilators doesn’t diminish with rising costs.

That makes the healthcare industry an unwilling participant in the broader economic chess match, tasked with maintaining care quality while absorbing the costs of geopolitical volatility.

A Push for Resilience, But at What Price?

In the long term, many analysts agree that the U.S. does need to diversify its supply chain, particularly for critical health and defense-related products. But there’s a difference between gradual realignment and shock therapy.

A 145% tariff with only 90 days’ notice — and no formal carve-outs for essential medical imports — forces healthcare institutions to choose between financial solvency and clinical readiness. For patients, that’s not a choice they should ever be asked to make.

The keyword “reshoring medical manufacturing USA” has seen increased activity, reflecting interest in long-term solutions. But experts caution that reshoring is not a panacea — especially without coordinated investment and policy support.

Final Thoughts

Tariffs may be a tool of economic policy, but their effects reach deep into the tissues of public health. Trump’s 145% tariff on Chinese goods may be aimed at trade imbalances, but the collateral damage could be felt in hospital corridors and patient rooms across the country.

As with many aspects of healthcare finance, the real challenge is not just balancing books — it’s balancing values. Do we pursue economic independence at the cost of patient care? Or do we find a middle path that promotes resilience without sacrificing access?

For now, one thing is clear: in the war of tariffs, healthcare may become the unintended battleground.