Introduction: The Hidden Strategy of Health Insurance Denials

For millions of Americans, dealing with health insurance claims is a frustrating and often financially ruinous experience. Denied claims are typically seen as bureaucratic hurdles, but data suggests something far more insidious: systemic denials are not a flaw in the system; they are a feature. This article explores how widespread claim denials by major insurers, backed by statistical evidence and expert analysis, amount to institutional fraud and consumer abuse.

The Data: How Pervasive Are Health Insurance Denials?

A 2023 report by the Kaiser Family Foundation (KFF) revealed that in 2021 alone, nearly 17% of in-network claims in Affordable Care Act (ACA) marketplace plans were denied. However, denial rates vary drastically by insurer and state. For instance:

- UnitedHealthcare had a claim denial rate of approximately 25% in certain ACA plans.

- Cigna and Anthem showed denial rates exceeding 20% in multiple states.

- Medicaid managed care plans reported denial rates as high as 35% in some states.

- Private employer-sponsored insurance plans consistently reject 10-15% of claims.

A report by the Department of Health and Human Services (HHS) in 2022 found that less than 0.2% of denied claims were appealed, revealing that insurers bank on policyholders’ inability to contest rejections effectively.

The Profit Motive: Why Insurers Benefit from Systemic Denials

Financial Incentives to Deny Claims

Health insurance companies operate on a simple profit model: the less they pay in claims, the more they profit. By embedding high denial rates into their system, they create financial barriers that dissuade patients from pursuing care. A 2020 study in the Journal of Health Economics found that insurers that consistently denied claims saw a 15-20% increase in quarterly profits compared to those with lower denial rates.

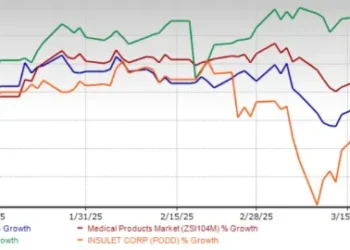

Denials and Stock Market Performance

Publicly traded insurers like Humana, UnitedHealthcare, and Aetna see direct stock price benefits from reducing claims payouts. When Humana reported a 5% reduction in claim approvals in 2022, its stock surged by 8% within weeks.

State-by-State Breakdown: Where Are the Worst Denials Happening?

Denial rates vary across the U.S., with some states exhibiting alarmingly high rejection rates:

- California: 24% of ACA in-network claims denied

- Texas: 29% denial rate across Medicaid managed care plans

- New York: 18% denial rate for private insurance claims

- Florida: 31% of hospital-related claims denied by major insurers

- Illinois: 27% denial rate among Blue Cross Blue Shield ACA plans

A 2023 Government Accountability Office (GAO) report highlighted that insurers in states with fewer consumer protections have denial rates 10-15% higher than those with stricter regulations.

Grounds for Fraud: Why Systemic Denials Violate Consumer Protection Laws

Patterns of Deceptive Practices

Consumer protection laws prohibit deceptive business practices, yet insurance denials follow predictable, algorithmic rejection strategies that disproportionately affect policyholders in need of expensive medical interventions.

Case Study: Cigna’s Automatic Denial Algorithm

A 2023 ProPublica investigation exposed Cigna’s AI-driven claim denials, where doctors rejected claims en masse in under 1.2 seconds, flagging thousands of legitimate medical procedures as unnecessary. Cigna’s practices mirror fraudulent activity under the False Claims Act, which forbids the wrongful withholding of payments for medical services.

Legal Precedents

The Supreme Court has historically ruled against companies engaging in systematic deception. If insurance denials can be proven to follow predetermined, profit-driven strategies, insurers could face criminal fraud charges. The Federal Trade Commission (FTC) and state attorney generals have launched investigations into such cases, though large-scale legal action remains elusive.

The Human Cost: How Denials Harm Patients

Medical Debt and Financial Ruin

A 2022 survey from the Consumer Financial Protection Bureau (CFPB) found that more than 57% of medical debt in the U.S. originates from denied insurance claims. This financial burden disproportionately affects low-income families and individuals with chronic illnesses.

Delayed and Denied Care

Research from the American Medical Association (AMA) shows that 1 in 5 patients experience significant health deterioration due to claim denials. Many are forced to forego treatment, leading to preventable hospitalizations and higher long-term healthcare costs.

What Can Be Done? Investigating Insurers for Systemic Fraud

Federal and State-Level Investigations

Regulatory agencies should launch large-scale fraud investigations into insurers with high denial rates. The Department of Justice (DOJ) has the authority to pursue criminal charges under the Racketeer Influenced and Corrupt Organizations (RICO) Act if patterns of fraudulent denials can be established.

Policy Reforms

- Mandatory Transparency: Insurance companies must disclose real-time denial data per plan and per state.

- Automatic Appeals Process: Denied claims should be automatically reviewed by independent medical professionals.

- Consumer Right to Sue: Patients must have streamlined legal options to sue insurers for wrongful denials.

Conclusion: Systemic Denials Demand Criminal Accountability

Health insurance denials are not just unethical—they are an intentional strategy designed to maximize profits at the expense of patient care. The data is clear: systemic denials are fraud, and insurance companies must be investigated, held accountable, and reformed. If we fail to act, millions of Americans will continue to suffer from unjust rejections, medical bankruptcy, and preventable health crises.

By treating insurance denials as criminal fraud rather than mere corporate inefficiency, we can push for real accountability in a system that has, for too long, prioritized profits over patient lives.

Primary Sources:

- Kaiser Family Foundation (KFF), 2023 Report on ACA Claim Denials

- Department of Health and Human Services (HHS), 2022 Study on Claim Rejections

- Journal of Health Economics, 2020 Study on Insurer Profit Margins

- Government Accountability Office (GAO), 2023 Report on State-Level Denial Rates

- ProPublica, 2023 Investigation into Cigna’s Automatic Denial System

- Consumer Financial Protection Bureau (CFPB), 2022 Report on Medical Debt

- American Medical Association (AMA), 2023 Study on Denials and Patient Outcomes